If you plan to buy or sell a business, you need to understand business purchase agreements. These contracts are necessary when one wants to transfer ownership, so consider this your guide to business purchase agreements and how to draft one up for your business.

Contents hide

Business purchase agreements are simply the contract that officially and legally withdraws ownership of a business from the seller and places it on a new owner (the buyer). When people discuss ‘selling their business’, they will use a this contract.

In the business world, people often refer to these documents as BPAs.These contracts transfer ownership of not just real estate but all assets, finances, trademarks, and anything else associated with the business.

For example, if a small business owner wishes to retire from their small business, they administer a business purchase agreement. The purchase agreement will transfer ownership to another family member, close friend, or willing individual.

Another example is when a new business becomes a fast success, and larger companies become interested in acquiring the name and operations to better their own corporation. An example of a large corporation using business purchase agreements to become an umbrella company is Wexner Companies.

They began with the popular retail store The Limited but quickly acquired Abercrombie and Fitch, Bath and Body Works, and Victoria’s Secret soon after the stores launched and exemplified rapid success.

The owners of Abercrombie and Fitch, Bath and Body Works, and Victoria’s Secret signed BPAs to transfer ownership of their businesses to Wexner Companies.

Then, all business responsibilities and operations fall under the new owner, and the old owner is separated from the business, barring they don’t hold any shares.

If a BPA is not drawn up and signed by all parties involved, the official ownership of the business will remain the same, despite changes in operations.

The business sale contract legitimizes the transfer of ownership, which also transfers the responsibility of business taxes and any debts the business may have.

If you’re wondering where to start, refer to the steps below. These steps will help you begin drafting a business sale contract the correct way.

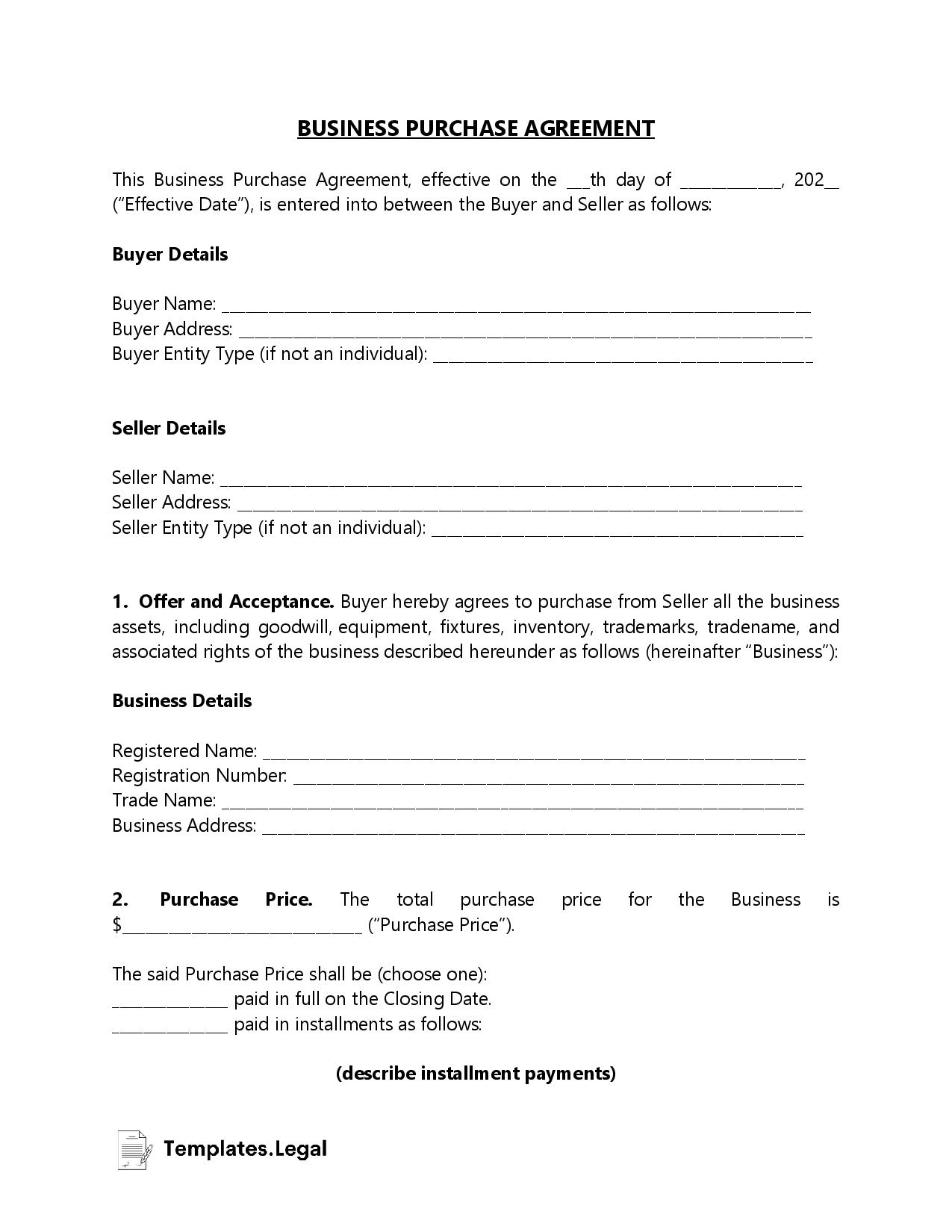

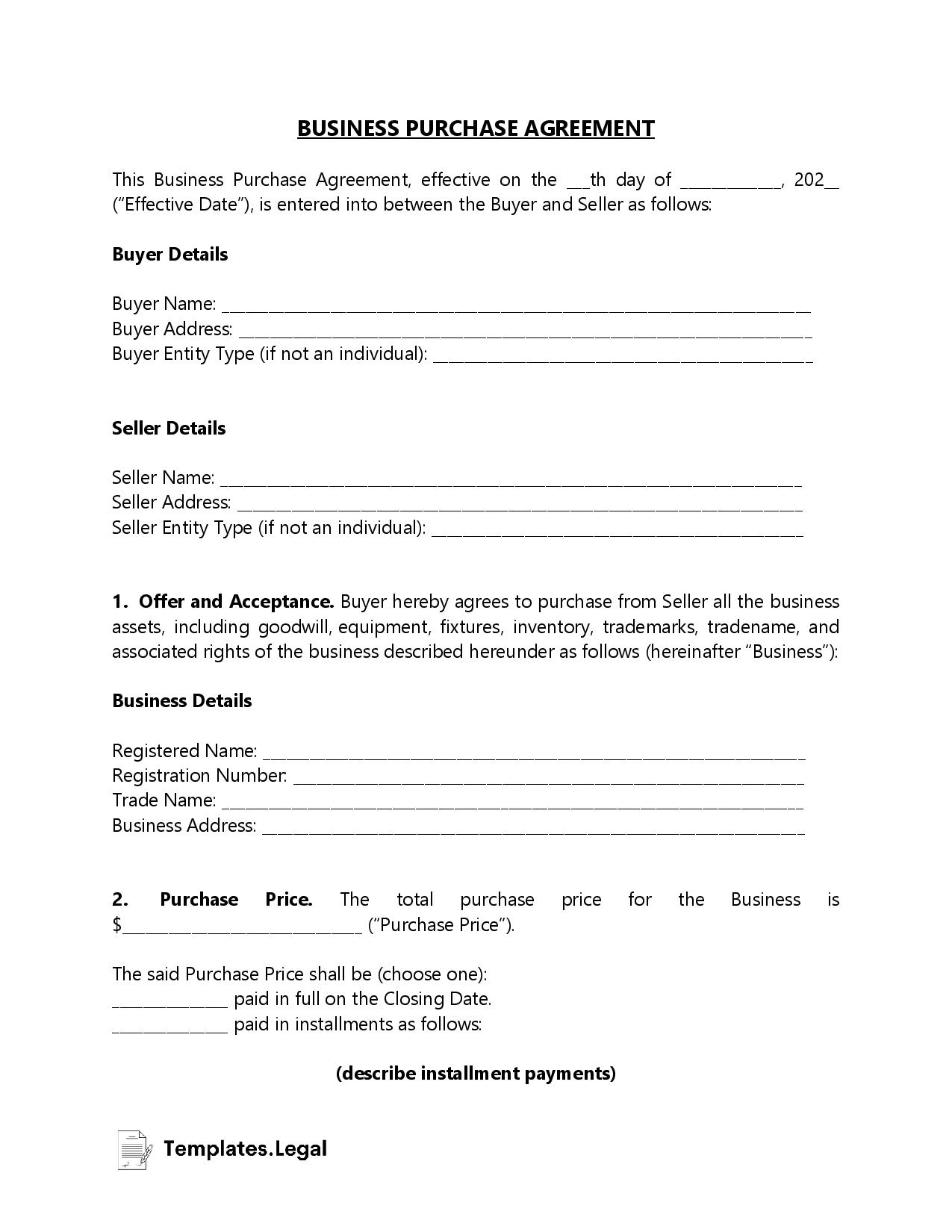

For a BPA to be legally binding, it must include the following sections with detailed information:

These documents must be executed to the letter, or there can be severe ramifications down the road if disputes over ownership arise. It is also imperative that the contracts are completely factual. Illegitimate statements can void the contract, transferring ownership back to the original seller.

Business purchase agreements occur every day in the US, but that doesn’t mean you should be careless when drafting and singing them. Make sure you consider all aspects of the business and if you take anything away from this guide, let it be that you should involve an attorney.

Whether you have a relationship with or trust the other party, having an accountant and attorney facilitate the contract can save both parties from problems and disputes later on.

Business purchase agreements can be new territory for many. Below are common questions that both sellers and buyers ask when dealing with them.

How do you write a business purchase agreement?The best way to write a BPA is to contact a lawyer specializing in business exchanges. You can provide them will all of the necessary information, and they will draw up a, typically, iron-clad contract for both parties to sign.

Otherwise, you should use a BPA template provided by the government and fill it out carefully. But you take some level of risk, whether you’re the buyer or seller, that the contract may have gaps or loopholes you’re unaware of.

What does a business purchase agreement include?A BPA must include all relevant information on the business’ identity, the seller, the buyer, business assets, and business liabilities. The document is meaningless and does not affect the ownership of the business until both the seller and buyer sign it. The signatures make the document legally binding as long as all information is factual and accurate.

Is a business purchase agreement legally binding?If written correctly and signed by the appropriate parties, a BPA is legally binding. Once it is signed, it is officially valid, and the ownership transfers in the eyes of the law.

Can you back out of a business purchase agreement?Yes, you can always back out until both signatures are on the document. Before the contract is officially signed, there is always an opportunity to refuse to sign and cancel the purchase agreement for business. Both the seller and the buyer can walk away from the business sale contract for whatever reason.

However, depending on how far you are into the process and what you signed, you may lose a deposit due to a breach of contract. If there is a valid reason for backing out, you may get the deposit back.

Valid reasons include one party providing false information or a drastic change in the business’ debts or assets.

Do you need a lawyer for a business purchase agreement?echnically you do not need a lawyer for a business sale contract. But not using a lawyer for the documents can be a mistake if something goes wrong in the sale due to improper paperwork.

But thanks to business purchase agreement templates available online, people can successfully use a free business purchase agreement, as long as both parties agree. If the business is small, this can save both parties money but is ill-advised by most in the business world.

Most BPAs involve both a lawyer and an accountant to ensure everything is correct and all assets and liabilities are accounted for.